owner's draw vs salary uk

From the Account Type drop-down choose Equity. Single-member LLC owners are considered to be sole proprietors for tax purposes so they take a draw like a sole proprietor.

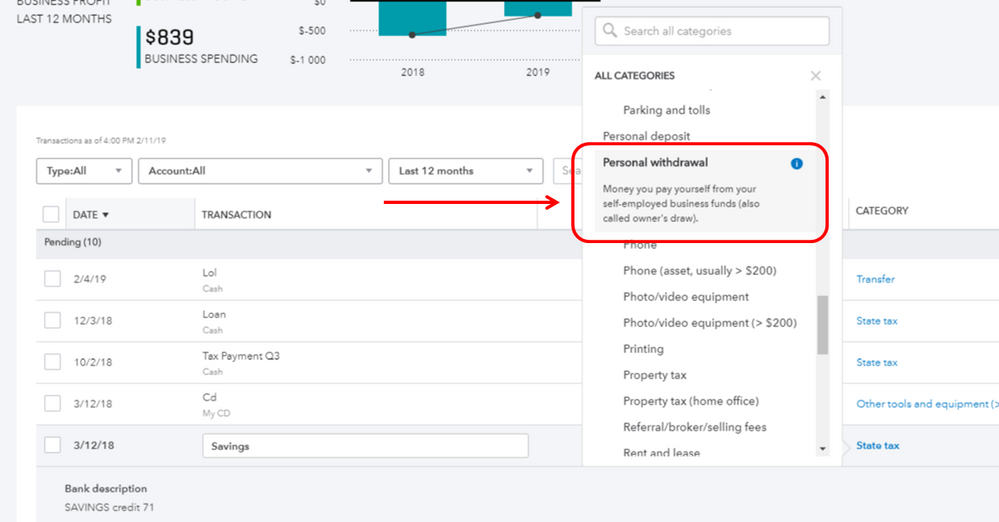

Solved Owner S Draw On Self Employed Qb

Draws can happen at regular.

. The business owner takes funds out of the business for personal use. In the Chart of Accounts window select New. Salary and Bonuses.

A draw against commission is a type of incentive compensation that functions as guaranteed pay that sellers receive with every paycheck. Typically you can take an owners draw if you have a sole proprietorship partnership or an LLC and you can take a salary when your business is a corporation or an LLC taxed as a corporation. When entering a check written to the owner for personal expenses post the check to her draw account.

Through the payment of dividends a salary or drawings. Receiving dividends from the business. An owners draw occurs when a business owner withdraws funds from their company for personal use rather than paying themselves a salary.

Draws are typically a short-term incentive and a way to provide your team with income stability. As an example assume an employee receives a 1000 per month recoverable draw. A personal salary will show a steady earned employment income and is more likely to help you be eligible.

The right choice depends largely on how you contribute to the company and the company. Post checks to draw account. At a 2000000 valuation Seed Legals found that the average founders salary was 25000 rising to 52000 and 80000 at 4000000 and 6000000 respectively.

The draw amount is typically pre-determined and acts similar to a cash advance for reps. No expense is recognized by the business. In the case of salary vs.

As your company grows and the chances of success and stability increases then founders can increase their salary compensation over that period. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. The National Insurance rate for employees is 12 between 8632 and 50024 and 2 above this figure.

Select the Gear icon at the top and then select Chart of Accounts. The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account. Then each member gets taxed on their distribution of profits.

Directors of owner-managed companies often draw low levels of salary typically between 7500 and 9500 per annum. In November he receives his 1000 paycheck and his sales commissions are 1200 so his draw balance is now 150. The reason for this is because a salary attracts a National Insurance levy.

By salary distributions or both. The more you pay in salaries the lower your profit. This article will explain the difference between salaries dividends and drawings and the effects each will have on your business.

Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use. Depending on your business structure you may be able to pay yourself an owners draw. PAYE salaries are an expense and appear in the Profit and Loss Account.

An S-corp offers business owners three basic options for paying themselves. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. Draws are pretty straightforward when 1 your company is a sole proprietorship a partnership or an LLC that is structured for tax purposes as either of the previous kinds of business entities and 2 the money is coming out of your owners equity.

The balance for October is -50 in his draw account. Salary is direct compensation while a draw is a loan to be repaid out of future earnings. Generally when operating as a Company Shareholders have three options as to how they can extract profits from the business.

The reason for needing to take action stems from the fact that owner-managers who run their businesses through corporations can choose to receive compensation as either a salary including a bonus or dividends. Before you can decide which method is best for you you need to understand the basics. Dividends are franked at the companys tax rate currently either 275 or 30 depending on the size of the company.

If salary compensation is chosen the corporation claims a deduction against its income for the amount of salary or bonus paid and the. Notice that both accounts are balance sheet accounts. If your drawings figure is much larger than in previous years it follows that your ACC levies will be larger as well.

Drawings are not expenses and dont impact the companys profit. Paying owners draws is even easier if you use a PEO for your business. Dividends salary wins out here.

Multiple-member LLC members are considered to be. The money you take out reduces your owners equity balanceand so do business losses. A check written to the owner will be debited to her draw account and credited to the appropriate bank account.

Most banks prefer seeing consistent predictable income if you are looking to qualify for a mortgage. Owners equity is made up of a variety of funds including money youve invested in your company. In October he receives his 1000 paycheck but his sales commissions are only 950.

A draw is usually smaller than the commission potential and any excess commission over the draw payback is extra income to the employee with no limits on higher earning potential. Another big difference between the two concerns potential mortgage applications. What is an owners draw.

There are many challenges to running a. LLC Owners Take a Draw or Distribution. To create an Equity account.

The members have agreed. Understand the difference between salary vs. As a Justworks customer you can schedule an owners draw a payment for the amount needed and we can help with your reporting questions.

Owners of limited liability companies LLCs called members are not considered employees and do not take a salary as an employee. From the Detail Type drop-down choose Owners Equity. The credits for the tax that has been paid will be passed on to the shareholder which will reduce the amount of tax they have to pay on the dividend.

For example lets say an LLC has two members with one owning 60 of the company while the other owns 40. Draws simply reduce the owners equity as they recover their initial investment or take the profits out of the business.

Solved Owner S Draw On Self Employed Qb

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Salary Business Owner Business

How To Decide What To Pay Yourself As A Small Business Owner Personal Financial Statement Small Business Owner Business Owner

How To Pay Yourself As A Small Business Owner Gusto

Tired Of Gmail Try A Privacy First Email Provider In 2020 Email Providers Email Security Email Client

Geotechnical Engineering The In Demand High Pay Easy Entry Job You Ve Likely Never Heard Construction Equipment Heavy Equipment Heavy Construction Equipment

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk Blog

Employment Agreement Template Word Best Of Employment Agreement Template Contract Template Employment Business Budget Template

How To Pay Yourself From Your Business Salary Vs Draw And How Much Business Business Entrepreneur Online Boutique Business

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Graphic Designers Jobs Career Salary And Education Information Education Information Graphic Design Education

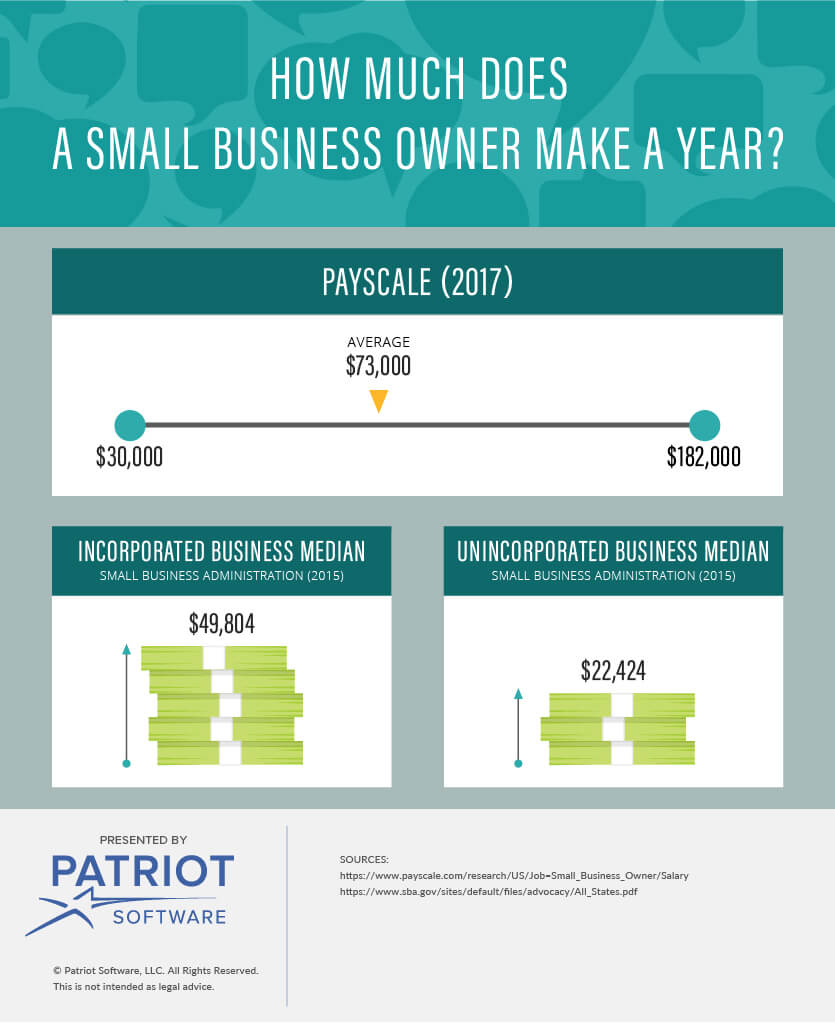

How Much Do Small Business Owners Make Surprising Averages

Pdf Employment Contract Template Uk The Cheapest Way To Earn Your Free Ticket To Pdf Employ Contract Template Contract Business Budget Template

How To Pay Yourself As A Business Owner Leadership Girl Business Owner Operations Management Business

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

How A Sole Proprietor Pays Income Tax And Other Taxes Sole Proprietor Income Tax Income

Unique Start Up Budget Template Xls Xlsformat Xlstemplates Xlstemplate Business Budget Template Business Expense Small Business Expenses